When in need of quick cash, payday loans may seem like the perfect solution to cover expenses before your next paycheck arrives.

While these loans are legal in certain states, they’re usually expensive and can trap borrowers in an endless cycle of debt. Before considering taking out one of these loans, be sure to research different lenders and fees carefully, as there may be better terms or rates available through other sources; and only borrow what is absolutely necessary without rolling over your loan into additional payments.

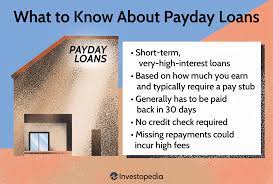

Payday loans are short term cash advances of small amounts that must be paid back with your next paycheck. Although availability varies by state, qualifying for one is usually straightforward as long as you have a steady source of income, valid identification documents and an active checking account. Though regulated heavily, unlicensed lenders still prey upon those in financial need by charging exorbitant interest rates and keeping repeat borrowing and rolling over fees within their grasp.

To apply for a payday loan, you’ll need to provide personal details like your name, address and social security number as well as proof of employment and income verification. In addition, banking details will also need to be provided including bank name, account number and routing number. Many payday lenders use soft credit checks that don’t significantly lower your score whereas hard checks could lower it temporarily.

Repayment terms of payday loans depend on each lender; most require the borrower to repay both principal and interest by their next payday, or within several weeks at most. Some may provide longer payment plans if borrowing larger sums; all terms will be laid out clearly in their loan agreement.

Not everyone needs payday loans for emergency financing purposes – there are other instant loans that offer similar advantages that may help fund businesses or purchase homes with more favorable terms than payday loans; these instant loans often have higher interest rates as well, making it hard to obtain them if your credit history is poor.

Based on your situation, borrowing money from friends or family may be preferable to payday loans. Other viable alternatives to payday loans may include tapping savings accounts or using credit cards to obtain funds; or applying for a personal loan with a bank which tends to have more favorable interest rates compared with payday loans and even reporting payment history to credit bureaus. Even with poor credit it may still be possible to find suitable personal loan offers – just research lenders carefully beforehand! Also devise a repayment strategy so your loan is paid back on time and in full when using payday loans or payday lenders are the only options.