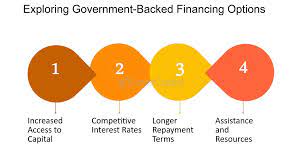

Government backed financing solutions exist for small business owners looking for funding solutions. These loans offer competitive

interest rates, flexible terms, and easy qualification requirements for entrepreneurs with no credit history, little experience running their own company, or new business models that would otherwise struggle to secure funding due to credit histories, lack of years in operation, or new business models. In some instances, federal guarantees reduce risks for lenders while simultaneously opening financing to more entrepreneurs.

The Small Business Administration (SBA) offers several loan programs for entrepreneurs and small business owners alike, including the 7(a) business loan guarantee program which assists with startup costs, growth expenses and acquisition, construction or refinancing for existing businesses as well as commercial real estate acquisition, construction or refinance. Another loan program available through SBA is 504, which supports businesses which will create jobs or meet a need in local markets by covering part of their loans upfront with their payment guarantee – at least 20% must come from personal guarantees made by individuals personally guarantors themselves.

No matter what loan type it is, the SBA requires that borrowers submit a detailed business plan and financial projections as part of the application process. These projections will reassure lenders that you can service and repay on time. While not directly providing loans themselves, Lender Match matches you up with lenders who specialize in your specific type of business via its Lender Match tool and other resources; some lending partners offer these loans through traditional branches while others work exclusively online.

Before beginning the application process for any loan or grant you want, it’s essential to thoroughly research its eligibility criteria and review any necessary guidelines. Don’t waste your time applying for grants that don’t meet your needs, such as veterans or women-run business grants; and others have geographic restrictions like USDA loans available only in rural areas.

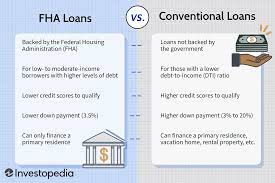

While government loans like those provided by SBA and USDA often have less restrictions than conventional loans, securing one isn’t always straightforward. You typically need strong credit and financial history as well as meeting size standards to qualify as a small business. Although some lenders may accept your application despite meeting all these criteria, alternative business financing such as private loans should always be explored before turning to government lenders for funding.

The primary form of government financing is loans, which must be repaid. But the federal government also provides grants, which don’t need to be paid back, that target specific projects or business needs. Grants such as those available through the SBA’s Community Grants Program or local or state organizations acting as go-betweens between them and partner lending organizations could provide startup capital, as well as grants targeted towards certain groups like veterans or those with disabilities.