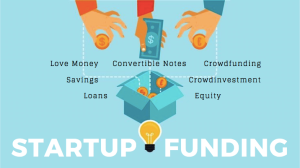

There are various means by which a startup business can be funded, but government loans specifically targeted toward them offer great

options. They come from various organizations with differing limits and pricing structures as well as private lenders who may also provide startup business funding with differing terms and prices.

For you to qualify for a startup business loan government, several criteria must be fulfilled. First and foremost is being able to demonstrate that your projected operating cash flow can support repaying the debt in full; you should have explored and exhausted alternative funding solutions before considering government startup business loans; have significant equity invested in your business and meet other eligibility requirements; finally demonstrate your business is at least in its seed stage and likely successful.

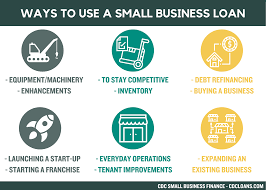

To assist aspiring entrepreneurs find an appropriate business loan, the UK government launched the Start Up Loans Company as part of the British Business Bank. This program offers loans up to PS25,000 that can be used for various aspects related to startup business development. In addition to loans, this programme also offers mentoring support over 12 months for free.

SBA loans for startup business loans may also be made available. These programs typically involve an extended application process with strict eligibility requirements. The SBA Lender Match tool can help connect you with lenders that offer loans suitable for your business needs. In order to qualify, your startup business must be at an early stage and your credit score must exceed 680. Your company must not have been recently involved with bankruptcy filings or foreclosure proceedings, according to SBA requirements. Furthermore, they provide loan guarantees through community development financial institutions (CDFIs) and local lending organizations; specifically the CDFI loan guarantee program helps businesses that would not normally qualify for traditional business loans due to lack of collateral.

Venture capital, angel investors and crowdfunding platforms may all provide funding solutions for small businesses. Each source has their own benefits and risks; therefore it’s essential to carefully weigh each option before making your choice. At times, merchant cash advances may provide your business with the best financing solution. To understand your financing options, create a Nav account and connect your business data to discover personalized loan offers without harming your credit rating. Make the best decision for your company’s success! Max Freedman is an accomplished small business owner and the founder of a finance technology firm. His passion lies in supporting growing small businesses, so his software helps entrepreneurs compare merchant cash advance companies in order to find the most beneficial offer based on their individual requirements.