Businesses require cash in order to purchase equipment, pay marketing expenses or invest in other areas. If it does not have sufficient

cash on hand, loans can help cover expenses until more cash comes in. One popular form of lending for this purpose is through taking out term loans with predetermined repayment schedules and maximum borrowing amounts; other sources of financing could include business lines of credit and asset-based lending.

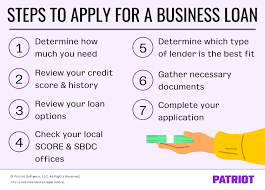

When shopping around for business loans, it’s essential to compare all available options and understand their varying mechanisms. Furthermore, it can be useful to look at a lender’s track record as well as read online reviews from previous small businesses that they have worked with to gauge how successful their company has been at providing support services for them.

Lenders typically require businesses to present an audited profit and loss statement as well as a financial projection or budget that details future income and expenditures. They may also want to see the business’s debt-to-income ratio, which shows how much debt the business carries relative to revenue, along with possible collateral such as real estate or equipment assets.

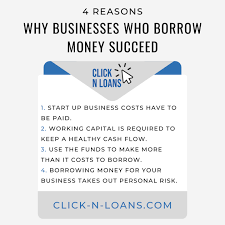

Many in finance and banking are familiar with the term “cash flow,” yet many don’t fully grasp its meaning. A company’s cash flow demonstrates how money enters and exits their company – ideally with more coming in than going out – in a healthy financial situation; otherwise it may hinder operations and remain unprofitable for business.

One of the main reasons a business borrows money is to fund growth – whether this means hiring new staff, expanding into new markets or offering new products and services. Loans provide necessary funding and lenders can assist businesses in devising the optimal growth strategies by providing funding solutions.

As you evaluate lenders, it’s useful to consider how efficient and streamlined their application and approval processes are – this will speed up how soon a company receives funding. Furthermore, lenders should offer various borrowing terms so the loan can be utilized as intended.

A business will choose its type of loan based on their unique requirements, with options such as business lines of credit being an ideal way to meet day-to-day expenses by borrowing only what it needs instead of incurring interest on an entire loan amount. Asset-based lending can also be an ideal solution for companies needing to purchase large assets. When considering this financing method, an independent appraisal should be carried out on any collateral used as security. Research the lender’s requirements for collateral as some may be more stringent. Traditional bank and SBA lenders will only accept certain forms of security while other lenders could be more accommodating.